To use the calculator key in the property price. Consideration or Adjudicated Value.

Compound Interest Calculator For Excel

From 1st April 2015 there will additional 6 government tax on total lawyer fee for Sales and Purchase Agreement.

. The Solicitors Remuneration Amendment Order 2017 SRAO has been gazetted and will be in force from 15 March 2017. December 16th 2021 5 Common Housing Loan Mistakes To Avoid. If say the negotiated rate is 02 the calculation is.

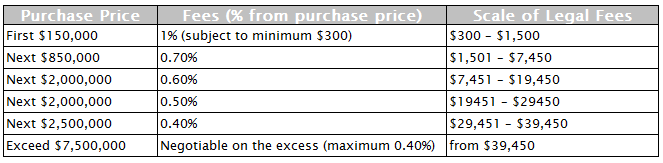

We recommend you to download EasyLaw phone app calculator to calculate it easily. The scale fees are as follow. Free access to 10 important Malaysias Statutes including Rules of Court 2012 Companies Act 2016 Penal Code and etc.

Loan Documentation Legal Fees. Total Loan Amount X 050. Calculate now and get free quotation.

The stamp duty for sale and purchase agreements and loan agreements are determined by the Stamp Act 1949 and Finance Act 2018The latest stamp duty scale will apply to loan agreements dated 1 January 2019 or later and to sale and. Legal Fee for Tenancy Agreement period of. 9 March 2017.

Sale And Purchase Agreement Legal Fees 2022 SPA Stamp Duty And Legal Fees For Malaysian Property. ACCESS NOW Testimonials What Others Say. Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia.

More tha RM 100000. The Legal Fee for a standard Sale Purchase Agreement is based on Solicitors Remuneration Order 2017. SPA Loan Agreement quotation includes Legal fees amount Disbursement Fees 6 SST and stamp duty.

Consideration or Adjudicated Value. 20 of the monthly rent. It includes a professional legal fee disbursement fee and stamp duty.

10 subject to a minimum fee of RM500 For the next RM500000. Next RM 90000 rental. Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia.

November 15th 2021 Lima Cara Bijak Untuk Refinance Rumah 2022. March 8th 2016 UPDATES ON STAMP DUTY MALAYSIA FOR YEAR 2022. How do I calculate the stamp duty chargeable on my property.

For the next RM2500000. Get quotation for free from law firm. Stamp Duty 100000 x 1 40000 x 2 6000.

Loan Agreement Legal Fees are about 2-3 from the Loan Amount. The scale fees are as follow. For the first RM500000.

Under the Stamp Act the stamp duty of the property is calculated on basis below-. For property price exceeding RM75 million legal fees of the excess RM75 million is negotiable but subjected to maximum of 05. 10 of principle legal fee min RM300 and max RM1200 2.

Key in your purchase price and our stamp duty calculator would let you know how much is the. First RM 10000 rental. SPA Stamp Duty.

If the property price is MYR 550000 the calculation is. Below are the legal fees stamp duty calculation 2022 when buying a house in Malaysia. Therefore there is another Legal Fee for this and we called it Loan Agreement Legal Fees.

Next MYR 400000 070 MYR 2800. For property price exceeding RM75 million legal fees of the excess RM75 million is negotiable but subjected to maximum. B1-32-3 Soho Suites KLCC No 20 Jalan Perak 50450 Kuala Lumpur Malaysia Branch.

First MYR 150000 100 MYR 1500. For the first RM500000. Loan Documentation Stamp Duty.

And 3 x RM450000 RM13500. For The First RM50000000 10 Subject to a minimum fee of RM50000 For The Next RM50000000 080. However the below home loan calculator provides an estimation of the repayment amount.

The amount may be different from individual banks or financial institutions. The calculation formula for Legal Fees Stamp Duty is fixed as they are governed by law. Legal fees for sale and purchase agreements and loan agreements are regulated by the Solicitors Remuneration Amendment Order 2017.

Legal Fees Stamp Duty Calculator For Sale PurchaseSP And Loan Agreement calculation and quotation for purchasing property in Malaysia Petaling Jaya KL Johor Bahru. Shall not exceed 050. The calculator will automatically calculate total legal or lawyer fees and stamp duty or Memorandum of Transfer MOT.

The Legal Fee for a standard Sale Purchase Agreement is based on Solicitors Remuneration Order 2017. The standard legal fees chargeable for tenancy agreement are as follows-. For the first RM 100000.

Latest Update 2022 Professional Legal Fees. Professional Legal Fees to be included 6 of government tax. Consideration or Adjudicated Value.

Legal advice for divorce family Law dispute debt recovery litigation probate estate SP corporate agreement mergers defamation due diligence employment. 10 subject to a minimum fee of RM500 For the next RM500000. For example Loan Amount is RM450000 So 2 x RM450000 RM9000.

Visualize the monthly instalment legal fees and stamp duties for buying a house in Malaysia. The legal fee calculator does not include the disbursement payable. The schedule below as a reference of stamp duty and legal fees when purchasing a house.

If the property price is MYR 10500000 the rate above MYR 7500000 is negotiable between the law firm and the client. Purchased Price 350000. Luckily Low Partners created a handy Legal Fee and Stamp Duty calculator which you can easily use to calculate the exact amount you need to pay when buying and selling a property.

6A Jalan Sepadu Taman United 58200. Both quotations will have slightly different in terms of calculation. Stamp Duty Legal Fees For Purchasing A House 2022.

Disbursement Fees to be ranging of RM1000-RM150000 based on estimation For first time house buyer stamp duty exemption is given to 1st RM 300k value for residential property under RM 500k. The SRAO makes several important changes to the Solicitors Remuneration Order 2005 SRO which sets out the fees payable to lawyers in property transactions. 25 of the monthly rent.

Legal Fees for property sales purchase mortgage loan. With above calculations there is miscellaneous fee for preparation of Sales and Purchase Agreement. Home mot calculator malaysia 2018.

This could be at least a few hundreds tobe add on. Check out our up-to-date Home Loan and Home Refinance comparison tools.

E Commerce Company In Indonesia Your Guide To Starting One

Stamp Duty Legal Fees Malaysia 2022 For Purchasing A House

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

Taxation System In Indonesia Your Guide To Income Taxation

Tax And Accounting Outsourcing Services In Bali Cekindo

How To Calculate Foreigner S Income Tax In China China Admissions

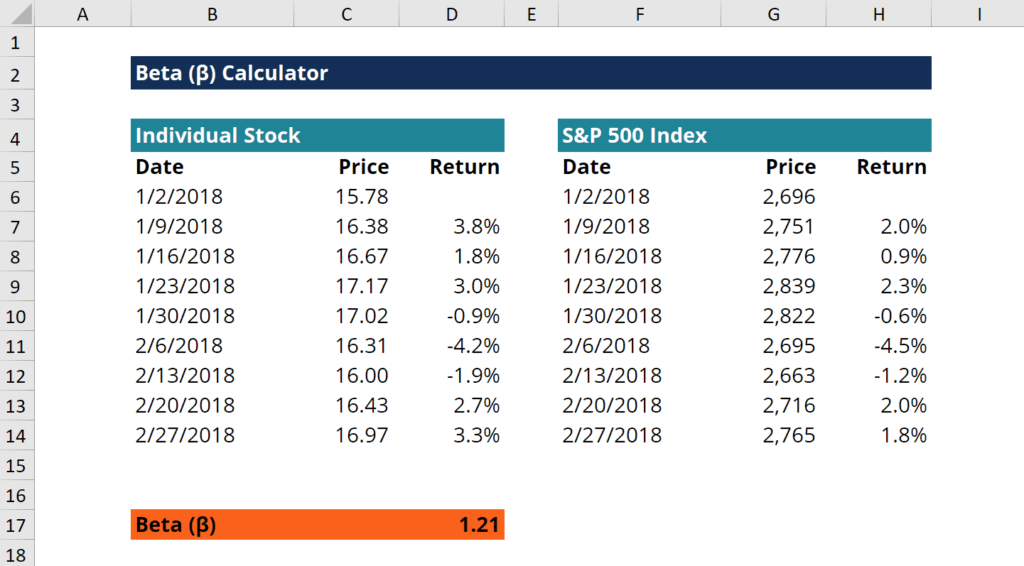

Beta What Is Beta B In Finance Guide And Examples

Ini 10 Berita Ekonomi Yang Paling Banyak Dibaca Tahun 2018 Halaman All Kompas Com

How To Calculate Foreigner S Income Tax In China China Admissions

Gratuity How To Calculate Rules Eligibility And Formula

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

Property Spa And Loan Legal Fees And Stamp Duty Calculator Mypf My

End Of An Era Ducati S Final 1299 Panigale R Motorcyle Ends The V2 Lineage Strong American Luxury Motos Deportivas Motos Cromadas Motos De Motocross

Calculators Legal Fee Sale Purchase Agreement Loan Agreement

Car Buying Legal Advice You Have To Know Honda Fit Hybrid Car Buying Honda Fit

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia